Tesla Motors Megafactories National Geographic Documentary

National Geographic 2015 Tesla Motors Factory MegaFactories Full Documentary HD

National Geographic: Supercars Tesla Motors

Tesla Motors Documentary

Archiv der Kategorie: Innovatoren

Easton LaChappelle – Unlimited Tomorrow

Easton LaChappelle has been taking apart things since he was a child and is now changing industries. At 14, he made his first robotic hand out of LEGOs, fishing wire, and electrical tubing.

We at Pioneers are proud to present our youngest speaker to date. We couldn’t miss the chance of flying out 19 year-old Easton LaChappelle all the way from Colorado. The young pioneer has been pulling things apart since the age of 14 and is now disrupting industries. His first robotic hand was made out of LEGO, proving that neither age nor money should decrease our game-changing ideas.

This tech hero has improved his self-taught robotics skills, and has turned his initial Lego design into a 3D-printed invention operated with his mind. His inspiration? A 7-year-old girl at a science fair, with an $80,000 prosthetic arm. Something he found outrageously unaffordable.

His improved prototype is already online for less than $400. This young genius has even impressed President Obama, who shook hands with one of his robotic arms. A unique success story, that has already landed him a job at NASA.

At only 19, he can already tell us all about founding his own company, Unlimited Tomorrow. Where he develops an exoskeleton to help paraplegics walk again. Easton’s robotic arm and designs are all open source, helping anyone to become their own engineer.

Read more here: http://pioneers.io/blog/people/easton-lachappelle

Doing Business the Steve Jobs Way

Source: http://mashable.com/2015/03/24/steve-jobs-leadership-biography/

That, in a nutshell, is the takeaway from Becoming Steve Jobs, a new biography of the late Apple CEO, which tries to provide nuance to the oft-told story of Jobs‘ professional rise at Apple, including the wilderness years that followed after being pushed out and his triumphant return.

The book’s authors, Brent Schlender and Rick Tetzli, suggest that much of Jobs’s professional image as a mercurial manager was shaped by „stereotypes that had been created way back in the 1980s,“ before he and Apple retreated from the press. „Perhaps that’s why the posthumous coverage reflected those stereotypes,“ the authors speculate.

Between that initial wave of press coverage and his return to Apple, Jobs‘ personality and management style shifted in subtle and not so subtle ways as a result of the struggles of NeXT, his follow-up effort, as well as inspiration from the creatives at Pixar, which he acquired and later sold to Disney. Just as importantly, the book claims Jobs was changed by falling in love with his wife, Laurene Powell Jobs, and starting a family.

Some elements of Jobs‘ management style stayed consistent, however.

He continued to push for „outrageous goals,“ as the authors put it, and he could still be severe and argumentative with colleagues. Yet the book suggests that his level of discipline, empathy and flexibility increased over the years to help compensate for his negative traits.

The book provides good lessons for all leaders, insofar as Jobs has become a widely observed case study for the archetype of the genius founder. The book highlights the sometimes contradictory leadership traits of a man who is quoted in the book as saying, „I didn’t want to be a businessman,“ and then went on to become arguably the most influential businessman of his generation. Here are the most revealing anecdotes.

Even visionaries need to hear realtalk

While Jobs often acted like someone who thought he knew best, the CEO nonetheless sought out mentors in the tech industry, including the founders of Intel, Hewlett Packard, Polaroid, National Semiconductor and others. Some, like Andy Grove, the former CEO of Intel, would remain lifelong advisors, sometimes to the exhaustion of the mentors:

Unable to sleep that night, Steve called his friend and confidant Andy Grove at 2 a.m. Steve told Grove that he was torn about whether or not to return as Apple’s CEO, and wound his way through his tortured deliberations. As the conversation dragged on, Grove, who wanted to get back to sleep, broke in and growled: „Steve, look. I don’t give a shit about Apple. Just make up your mind.“

Steve Jobs, the father figure

At NeXT, the computer company he launched after leaving Apple, Jobs was guilty of micromanaging, making impulsive bad hires and is described as an „equal-opportunity abuser“ who yelled at engineers as well as executives. But he also tried to be more of a „father figure,“ according to one former employee quoted in the book. His paternal instincts coincided with his own first attempt at being a father to the daughter he’d had out of wedlock and publicly rejected.

„Steve hosted annual ‚family picnics‘ for his employees in Menlo Park. They were kid-oriented Saturday affairs, featuring clowns, volleyball, burgers and hot dogs, and even hokey events like sack races,“ according to the book.

Later, at Pixar, Jobs gave a top filmmaker a small bonus and demanded he use it to buy a better car. „It has to be safe, and I have to approve it,“ Jobs is quoted as saying.

When he returned to Apple, Job is compelled to cut much of the staff and reorganize, but he expresses grief in a way that the brash young Jobs may not have.

„I still do it because that’s my job,“ Jobs is quoted as telling the authors. „But when I look at people when this happens, I also think of them as being five years old, kind of like I look at my kids. And I think that that could be me coming home to tell my wife and kids that I just got laid off. Or that it could be one of my kids in twenty years. I never took it so personally before.“

No reviews, little praise for direct reports

Those who worked for Jobs could expect an earful from the executive when dealing with him on any given day, but they rarely received formal reviews and feedback. „Steve didn’t believe in reviews,“ one former employee says. „He disliked all the formality. His feeling was, ‚I give you feedback all the time, so what do you need a review for?“

Likewise, he was less than generous in doling out praise to employees. Instead, he would show it by taking the best employees on walks. „Those walks mattered,“ recalled another employee. „You’d think to yourself, ‚Steve is a rock star,‘ so getting quaity time felt like an honor in some ways.“

Jobs‘ work/life balance

Early in his career, Jobs burned the midnight oil in the office along with much of his team, but by the time he returned to Apple, he was more focused on trying to balance his work with his new family.

Rather than hover over the shoulders of star engineers and programmers, he could do much of his work via email. So he would make it home for dinner almost every night, spend time with Laurene and the kids, and then work at his computer late into the night…

On many nights, Jobs would work alongside his wife, Laurene, at home. As his wife tells the authors, „Neither of us had much of a social life. It was never that important to us.“

Make time for spirituality and meditation

Some have wondered over the years how a man who famously went off to India and embraced Buddhism could reconcile that with running the largest corporation in the world. As it turns out, he continued to meditate until he and his wife had kids, which cut down what little free time he had left. In fact, according to the book, Jobs „arranged for a Buddhist monk by the name of Kobun Chino Otogawa to meet with him once a week at his office to counsel him on how to balance his spiritual sense with his business goals.“

Embrace life

After his first cancer surgery in 2004, Jobs‘ leadership style changed again. He had more sense of „urgency“ to pursue innovative products, and less time and energy to handle other business issues, ranging from human resources to manufacturing.

„When he came back from that surgery he was on a faster clock,“ Tim Cook, Apple’s current CEO, tells the authors. „The company is always running on a fast-moving treadmill that doesn’t stop. But when he came back there was an urgency about him. I recognized it immediately.“

Perhaps that’s why he and his team at Apple went on to accomplish so much in the seven years he had left.

Chinesischer Chemiekonzern ChemChina kauft italienischen Reifenhersteller Pirelli

Mit der Übernahme erhält ChemChina Zugang zur Technologie für die Herstellung von Premium-Reifen.

Der staatliche chinesische Chemiekonzern ChemChina will den italienischen Reifenhersteller Pirelli komplett übernehmen. In einem ersten Schritt haben sich die Chinesen für knapp 1,9 Milliarden Euro 26,2 Prozent der Anteile gesichert. Das Paket wurde dem Mehrheitseigner Camfin abgekauft. Der Preis je Aktie beträgt 15 Euro.

So viel wird auch den anderen Aktionären geboten. Gelingt die Komplettübernahme, müssten die Chinesen 7,1 Milliarden Euro auf den Tisch legen.

Die Italiener erhoffen sich von dem neuen Großaktionär einen besseren Zugang zum asiatischen Markt. So soll das Geschäft mit Lastwagen-Reifen mit Teilen von ChemChina zusammengelegt und so das Volumen in dem Bereich von 6 auf 12 Millionen verdoppelt werden.

Foto: REUTERS/DAVID W CERNY

Pirelli erzielte im Vorjahr in 160 Ländern mehr als sechs Mrd. Euro Umsatz und ist damit der weltweit fünftgrößte Reifenproduzent. Der Firmensitz soll in Mailand bleiben. Auch die Produktion soll in Italien weitergeführt werden. Die Übernahme soll bis zum Sommer abgeschlossen sein.Die Pirelli-Aktie legte am Montag mehr als vier Prozent zu.

Artikel aus: http://kurier.at/wirtschaft/unternehmen/chinesen-kaufen-italienischen-reifenhersteller-pirelli/120.983.575

Weitere interessante Artikel finden sie unter: www.kurier.at

You’re Never Too Old To Start A New Venture, Look At These Famous Entrepreneurs

Mark Zuckerberg and the current lot of 20-something CEOs are ruining it for people like us who’re facing a mid-life crisis. This infographic gets back at those young pricks and proves why it’s never to late to start your own venture.

Did you know?

McDonald’s founder Ray Kroc sold paper cups and milkshake mixers till he was 52

Harry Potter author J.K.Rowling was a single mom on welfare till she was 31

Harrison Ford was a carpenter till his 30s

Zara founder Amancio Ortega was a shirt shop helper till he was 30

Evan Williams co-founded Twitter at the age of 35

Niklas Zennstromm was 37 when he created Skype

Arianna Huffington started Huffington Post at the age of 54

Still not convinced? Here’s more:

So if you haven’t come up with that billion dollar idea yet, don’t worry, there’s still time.

Source: http://digitalsynopsis.com/inspiration/never-too-late-start-venture/

Siri creator Adam Cheyer nets $22.5 million for an Artificial Intelligence that can learn on its own

Viv Labs, a startup launched by a team that helped build Siri, just pulled in $12.5 million to finance a digital assistant that is able to teach itself.

TechCrunch first reported that Viv Labs has closed a Series B round led by Iconiq Capital that pushes the company’s valuation to „north of nine figures.“

A spokesperson for the company confirmed the investment to Mashable but declined to comment further.

According to TechCrunch, the company was not in need of new capital but was interested in the possibility of working with Iconiq, which Forbes has described as an „exclusive members-only Silicon Valley billionaires club.“ Together with a previous $10 million Series A round, the company has now raised a total of $22.5 million.

Unlike other digital assistants like Siri or Cortana, Viv can make up code on the fly, rather than relying on pre-programmed directives from developers.

Whereas Siri may be tripped up by questions or tasks it is not already programmed to understand, Viv can grasp natural language and link with a network of third-party information sources to answer a much wider range of queries or follow complex instructions.

Viv co-founders Dag Kittlaus, Adam Cheyer and Chris Brigham previously served on the team that created Siri, which started as an iPhone app before Apple acquired it in 2010 for a reported $200 million.

“I’m extremely proud of Siri and the impact it’s had on the world, but in many ways it could have been more,” Kittlaus told Wired last year.

The cofounders told Wired that they hope to one day integrate Viv into everyday objects, in effect making it a voice-activated user interface for the much-hyped „Internet of Things.“

The company plans to widely distribute its software by licensing it out to any number of companies, instead of selling it to one exclusive buyer. One potential business model mentioned in the Wired report is charging a fee when companies using the service complete transactions with customers.

Viv Labs is reportedly working towards launching a beta version of the software sometime this year.

Source: http://mashable.com/2015/02/20/viv-funding/

The company behind Viv, a powerful form of AI built by Siri’s creators which is able to learn from the world to improve upon its capabilities, has just closed on $12.5 million in Series B funding. Multiple sources close to the matter confirm the round, which was oversubscribed and values the company at north of nine figures.

The funding was led by Iconiq Capital, the so-called “Silicon Valley billionaires club” that operates a cross between a family office and venture capital firm.

While Iconiq may not be a household name, a Forbes investigation into its client list revealed people like Facebook’s Mark Zuckerberg, Dustin Moskovitz and Sheryl Sandberg, Twitter’s Jack Dorsey, LinkedIn’s Reid Hoffman and other big names were on its roster.

In addition to Iconiq, Li Ka-shing’s Horizons Ventures and Pritzker Group VC also participated along with several private individuals. This new round follows the company’s $10 million Series A from Horizons, bringing the total funding to date to $22.5 million.

Viv Labs declined to comment on the investment.

We understand that Viv Labs was not in need of new capital, but was rather attracted to the possibilities that working with Iconiq Capital provided. It was a round that was more “opportunistic” in nature, and was executed to accelerate the vision for the Viv product, which is meant to not only continue Siri’s original vision, but to actually surpass it in a number of areas.

Viv’s co-founders, Dag Kittlaus, Adam Cheyer and Chris Brigham, had previously envisioned Siri as an AI interface that would become the gateway to the entire Internet, parsing and understanding people’s queries which were spoken using natural language.

When Siri first launched its product, it supported 45 services, but ultimately the team wanted to expand it with the help of third parties to access the tens of thousands of APIs available on the Internet today.

That didn’t come to pass, because Apple ended up acquiring Siri instead for $200 million back in 2010. The AI revolution the team once sought was left unfinished, and Siri became a device-centric product – one that largely connects users to Apple’s services and other iOS features. Siri can only do what it’s been programmed to do, and when it doesn’t know an answer, it kicks you out to the web.

Of course, Apple should be credited for seeing the opportunity to bring an AI system like Siri to the masses, by packaging it up and marketing it so people could understand its value. Siri investor Gary Morgenthaler, a partner at Morgenthaler Ventures, who also invested personally in Viv Labs’ new round, agrees.

“Now 500 million people globally have access to Siri,” he says. “More than 200 million people use it monthly, and more than 100 million people use it every day. By my count, that’s the fastest uptake of any technology in history – faster than DVD, faster than smartphones – it’s just amazing,” Morgenthaler adds.

But Siri today is limited. While she’s able to perform simpler tasks, like checking your calendar or interacting with apps like OpenTable, she struggles to piece information together. She can’t answer questions that she hasn’t already been programmed to understand.

Viv is different. It can parse natural language and complex queries, linking different third-party sources of information together in order to answer the query at hand. And it does so quickly, and in a way that will make it an ideal user interface for the coming Internet of Things — that is, the networked, everyday objects that we’ll interact with using voice commands.

A Wired article about Viv and its creators described the system as one that will be “taught by the world, know more than it was taught and it will learn something new everyday.”

Morgenthaler, who says he’s seen Viv in action, calls it “impressive.”

“It does what it claims to do,” he says. The part that still needs to be put into action, however, is the most crucial: Viv needs to be programmed by the world in order to really come to life.

Beyond Siri

While to some extent, Viv is the next iteration of Siri in terms of this vision of connecting people to a world of knowledge that’s accessed via voice commands, in many ways it’s very different. It’s potentially much more powerful than other intelligent assistants accessed by voice, including not only Siri, but also Google Now, Microsoft’s Cortana or Amazon’s Alexa.

Unlike Siri, the system is not static. Viv will have memory.

“It will understand its users in the aggregate, with respect to their language, their behavior, and their intent,” explains Morgenthaler. But it will also understand you and your own behavior and preferences, he says. “It will adjust its weighting and probabilities so it gets things right more often. So it will learn from its experiences in that regard,” he says.

In Wired’s profile, Viv was described as being valuable to the service economy, ordering an Uber for you because you told the system “I’m drunk,” for example, or making all the arrangements for your Match.com date including the car, the reservations and even flowers.

Another option could be booking flights for business travelers, who speak multi-part queries like “I want a short flight to San Francisco with a return three days later via Dallas.” Viv would show you your options and you’d tell it to book the ticket – which it would proceed to do for you, already knowing things like your seat and meal preferences as well as your frequent flyer number.

Also unlike Siri today, Viv will be open to third-party developers. And it will be significantly easier for developers to add new functionality to Viv, as compared to Siri in the past. This openness will allow Viv to add new domains of knowledge to its “global brain” more quickly.

Having learned from their experiences with Apple, the Viv Labs team is not looking to sell its AI to a single company but instead is pursuing a business model where Viv will be made available to anyone with the goal of becoming a ubiquitous technology. In the future, if the team succeeds, a Viv icon may be found on Internet-connected devices, informing you of the device’s AI capabilities.

For that reason, the investment by Iconiq makes sense, given its clients run some of the largest Internet companies today.

We understand that Viv will launch a beta of its software sometime this year, which will be the first step towards having it “programmed by the world.”

Morgenthaler says there’s no question that the team can deliver – after all, they took Siri from the whiteboard to a “world-changing technology” in just 28 months, he notes. The questions instead for Viv Labs are around scalability and its ability to bring in developers. It needs to deliver on all these big promises to users, and generate sufficient interest from the wider developer community. It also needs to find a distribution path and partners who will help bring it to market — again, things that Iconiq can help with.

But Viv Labs is not alone in pursing its goal. Google bought AI startup DeepMind for over half a billion, has since gone on to aqui-hire more AI teams and, as Wired noted, has also hired AI legends Geoffrey Hinton and Ray Kurzweil to join its company.

Viv may not deliver on its full vision right out of the gate, but its core engine has been built at this point and it works. Plus, the timing for AI’s next step feels right.

“The idea of embedding a microphone and Internet access is plummeting in price,” says Morgenthaler. “If access to global intelligence and the ability to recognize you, recognize your speech, understand what you said, and provide you services in an authenticated way – if that is available, that’s really transformative.”

Uber auf dem besten Weg zum Mobilitätsgiganten

Krisenzeiten bei Uber – aber die Aussichten sind rosig

Es war ein Skandal von einer Größenordnung, dass ihn selbst ausgebuffte PR-Profis nicht mehr einfangen konnten: Die Uber-kritische Tech-Journalistin Sarah Lacy sollte mit einer Schmutzkampagne überzogen werden, pikante Details aus ihrem Privatleben ausgegraben werden – diesen besonders durchdachten Vorschlag äußerte Emil Michael, Ubers Senior VP for Business, am Freitag bei einer Veranstaltung in New York. BuzzFeed berichtete über die fehlgeleitete Idee; außerdem enthüllte das US-Medium, dass Uber-Manager auch Einblick in die Fahrtrouten und damit die persönlichen Daten von Journalisten nahmen. Das PR-Desaster war perfekt.

Ein Skandal, der zur Unzeit kommt. Denn eigentlich versucht das Unternehmen alles, um sein Arschloch-Image abzustreifen. Und dann sind da die schier endlosen Proteste von Taxi-Fahrern rund um den Globus, Taxizentralen, die mit einem weltweiten Verbund gegen den US-Konkurrenten aufrüsten; nicht nur in Deutschland legen sich die Gerichte quer, Uber muss Fahrer daher angeblich schon mit Sonderboni dazu bringen, überhaupt Fahrten anzubieten und wer dieser Tage in Berlin ein UberBlack-Auto rufen will, dem offenbart die App: keine Fahrer unterwegs, nichts, nada.

Uber geht durch die tiefste Krise seiner Unternehmensgeschichte. Und doch scheinen Investoren gewillt, auf die bereits vorhandenen anderthalb Milliarden US-Dollar an Funding bald noch eine oder gar zwei weitere Milliarden draufzulegen. Das Unternehmen, das bei der letzten Finanzierungsrunde im Juni mit 17 Milliarden bewertet wurde, wird dann irgendetwas zwischen 25 und mehr als 30 Milliarden wert sein.

Woher kommt dieses scheinbar grenzenlose Vertrauen? Was macht das Startup für Investoren derart attraktiv? Und wo steht das Startup, das heute schon längst nicht mehr nur ein Limousinen-Service ist, derzeit wirklich?

- Zusätzliches Kapital wäre für Uber tatsächlich nur ein nice to have. Von der letzten Finanzierungsrunde soll Uber noch eine Milliarde Dollar übrig haben. Das heißt, das Startup ist weit weg davon, dringend auf frisches Geld angewiesen zu sein – doch weil das Kapital billig ist und sich Investoren offenbar um Uber-Anteile regelrecht prügeln, ist der Zeitpunkt für weiteres Fundraising schlicht günstig.

- Die Umsätze des 2009 gegründeten Unternehmens zeigen steil nach oben: Nach Informationen von Business Insider dürfte Uber spätestens Ende 2015 auf einen Bruttoumsatz von zehn Milliarden US-Dollar zusteuern. Pro Fahrt behält das Unternehmen etwa 20 Prozent Gebühren ein – macht einen Nettoumsatz von zwei Milliarden. Laut CEO Travis Kalanick verdoppeln sich die Umsätze derzeit „mindestens alle sechs Monate“, in einigen seiner größten Märkte sei Uber bereits profitabel. Das Besondere: Den Löwenanteil seines Umsatzes macht Uber offenbar in weniger als zehn Städten auf der ganzen Welt. Das Wachstumspotenzial in den den restlichen 140 bereits erschlossenen Städten dürfte demnach gewaltig sein.

- Bisher ist Uber in 46 Ländern vertreten, mit dem frischen Kapital der nächsten Runde soll vor allem nach Asien, Lateinamerika, Osteuropa und Afrika expandiert werden. Das sind Regionen voller Wachstumsmärkte und mangelhaft bis gar nicht ausgebautem öffentlichen Nahverkehr – beste Voraussetzungen vor allem für die Low-Cost-Angebote von Uber.

- Uber dürfte dem Druck von Taxifahrern, Politik und Gerichten standhalten. Gesetzesänderungen kann Uber zwar nicht mit seinem Geld erkaufen (zumindest sollte das nicht möglich sein) – aber für die Lobbyistenschlacht ist das Unternehmen bestens gerüstet, Kalanick hat hierfür absolute Top-Leute wie Ex-Obama-Berater David Plouffe eingestellt, um die Stimmung zugunsten von Uber zu drehen. Da ist zwar noch einiges zu tun. Und die vergangenen Tage haben die Aufgabe nicht einfacher gemacht. Aber man muss auch festhalten: Bisher musste sich Uber wegen regulatorischen Drucks nur aus einer einzigen Stadt – Vancouver – zurückziehen.

- Neben Expansion in weitere Weltregionen gibt es bei Uber Pläne, in weitere Geschäftsfelder vorzustoßen. Das Startup, das einst als Limousinen-Service begann, macht heute schon viel mehr: Mitfahrgelegenheiten, Taxi-Vermittlung – und Warentransport. Uber hat schon mit dem Ausliefern von Mahlzeiten, Speiseeis oder Impfstoffen experimentiert. Mit UberEssentials kann man sich in Teilen Washingtons bereits heute Bedarfsgegenstände wie Halsbonbons oder Rasierklingen an die Haustür bringen lassen. Steht Ubers Logistik-Infrastruktur einmal, so sind noch viel mehr Anwendungen für Quasi-Echtzeit-Delivery denkbar. Eine „Kreuzung aus Lifestyle und Logistik“, so versteht sich das Uber der Zukunft.

- Mittelfristig will das Unternehmen damit auch noch den traditionellen Mietwagenmarkt obsolet machen – auf lange Sicht rechnen die Uber-Vordenker ohnehin damit, dass die ownership society zu Ende gehen wird, das eigene Auto in Städten und Agglomerationen überflüssig wird, weil Uber-Wagen zu einem vernünftigen Preis ständig verfügbar sind.

- Übrigens: Fahrer für die Uber-Flotte braucht das Unternehmen dann vermutlich nicht mehr. CEO Kalanick gilt als Fan selbstfahrender Autos. Bei denen ist eine weiteres Silicon-Valley-Unternehmen Vorreiter: Google. Über Google Ventures hat der Suchmaschinenkonzern übrigens mehr als eine Viertelmilliarde Dollar in Uber investiert. Kein Wunder, dass Google auch immer wieder als möglicher Käufer für Uber genannt wird. Den Investoren dürfte dieses Exit-Gedankenspiel gefallen.

Quelle: http://www.gruenderszene.de/allgemein/uber-krise-mobilitaetsgigant

Patente in Österreich – Hitliste der fleißigsten Regionen

Die Karte zeigt die Verteilung der zwischen 2009 und 2013 erteilten Patente je 10.000 Einwohner, aufgeschlüsselt nach Bezirken. Erfasst sind Unternehmen, Universitäten und private Tüftler, die vom Österreichen Patentamt einen 20 Jahre währenden Schutz erhalten haben. Insgesamt wurden im Erfassungszeitram 7533 Patente erteilt. Erkennbar ist, dass in jenen Bezirken mehr Patente eingereicht wurden, in denen viele Unternehmen konzentriert sind. Besonders sticht die Region von Ried im Innkreis bis Perg hervor. Nach absoluten Zahlen liegt übrigens der Grazer Motorenbauer mit 308 Patenten an der Spitze.

Quelle: http://derstandard.at/2000007836947/Erteilte-Patente-in-Oesterreich

Is Amazon A Giant Ponzi Scheme Dressed In Drag?

The recent run-up in Amazon.com’s (NASDAQ:AMZN) stock price inspired me to revisit an old thorn in my side. AMZN is up 12.2% since the beginning of 2013, despite a very tough retail sales environment and despite the fact that California and some other states now collect what is known as „the Amazon tax.“ In addition, a bill to collect a Federal Internet sales tax was reintroduced in Congress two weeks ago: Online sales tax.

With this in mind, I decided to peruse AMZN’s 2012 10-K, something I had not done in years, to see what was going beneath the headline „veneer“ applied heavily to AMZN’s quarterly sales and net income results.

I knew that AMZN was using some controversial accounting methodologies, but when I pulled apart the financial statements and applied some old fashioned financial analysis, what I found with regard to AMZN’s cost structure, cash flow and true profitability was quite shocking. Looking at some income statements, cash flow from operations and balance sheet indicators, some of which Wall Street never discusses – AMZN looks somewhat like a Ponzi scheme. I say this because I believe it is likely that a serious cash problem for AMZN will develop if its sales growth slows down or even goes flat.

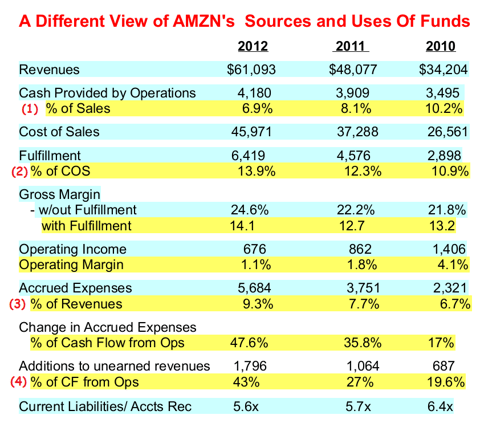

Let’s look at some numbers I put together by „pulling apart“ AMZN’s financial statements from its 2012 10-K (linked for your convenience). I created the table below to focus on what I consider to be the key metrics in understanding the true ability of AMZN’s business model to generate meaningful cash flow. Standard GAAP/adjusted-GAAP accounting statements often use accounting gimmicks that mask true profitability, which I’ll demonstrate below:

First, I wanted to look at cash flow generated by operations. This number is a fairly „clean“ indicator of how profitable the business model is, as it adjusts the reported income for all non-cash charges, adjusts for any non-operating gains/losses and reflects cash required to finance receivables and make vendor financing payments. As you can see, despite robust sales growth over the last three years, the cash generated by each additional dollar of sales is decreasing rapidly, as reflected by the trend shown in line (1) above. While it’s true that a smaller percentage of a growing sales number is still an increase, you can see that from 2011 to 2012 sales jumped by $13 billion but operational cash flow only increased by $271 million. This is a red flag. Please note, this cash flow number does not include AMZN’s big capex program – it’s purely a measure of AMZN’s organic operational profitability

Second, I believe a big part of the declining cash flow margin comes from AMZN’s cost of fulfillment – the cost delivering products to the end-buyer. I have always believed that AMZN’s business model generated tremendous sales growth because AMZN’s fulfillment strategy, in effect, heavily „subsidizes“ the all-in price paid by the customer. As you can see in (2) above, AMZN’s fulfillment costs have increased as a percent of its cost of goods sold in each of the last three years.

In fact, the way AMZN accounts for fulfillment is quite controversial: AMZN’s accounting. AMZN does not include fulfillment costs in its cost of goods sold (COGS), despite the fact that shipping – getting sold products to the buyer – is an integral part of the all-in cost of products sold in AMZN’s business model/strategy. AMZN’s „holy grail“ is that it can sell products over the Internet more profitably than „brick and mortar“ retailers, so the cost of delivery should be part of the cost of sales.

It’s a grey area of FASB rules, but not including this expense in the COGS distorts AMZN’s gross margins vs. that of competitors. (2) in the table above shows AMZN’s gross margin with and without fulfillment costs. As you can see from the difference in the two metrics, AMZN is heavily incentivized to keep the cost of fulfillment out of its COGS calculation. Gross margin is a key metric for analyzing profitability. In 2012, Target’s (NYSE:TGT) gross margin was 31%, Wal-Mart’s (NYSE:WMT) was 25% and Best Buy’s (NYSE:BBY) was 24.6%. You can see why AMZN has refused to consider fulfillment costs as part of the cost of a product, despite the fact that it is a key component in generating revenue. Fulfillment costs have been a rising part of AMZN’s overall product cost. As the cost of energy, and there the cost of shipping, increases it will put even more of a squeeze on the cash margin AMZN earns with each sale.

Third, AMZN’s operating margin is razor thin compared to its comparables. You can see from (3) in the table above that it’s been deteriorating quickly over the last three years. For 2012, TGT and WMT had operating margins of 7.6% and 5.6%, respectively. Remember, AMZN’s theory with its business model is that it can operate less expensively than its „brick and mortar“ rivals. The numbers for the last three years suggest that AMZN fails to deliver on this.

Let’s now look a little more deeply at the cash being generated by AMZN’s operations and why I believe AMZN resembles more of a Ponzi scheme than people realize. In addition to cash being generated by sales, „cash provided by operations“ also includes changes in working capital. Inventory is a use of cash; accounts receivable, accounts payable and other current liability accruals are sources of cash.

Retailers tend to have a much larger amount of accounts payable than they do receivables. Cash comes immediately from sales and companies negotiate payment terms from vendors, etc, thereby giving retailers the „float“ on cash generated by operations. In order for this model to work, it is important for sales to grow over time, as the „velocity“ of „cash in“ needs to stay ahead of the velocity of „cash out,“ otherwise a liquidity problem can develop.

I chose to isolate and focus on AMZN’s accrued expenses because the payables have been increasing at a normal rate. However, the accrued expense account (3) has been increasingly a significant portion of AMZN’s „cash provided by operations,“ – its „cash in.“ As you can see from the table above, accrued expenses are growing and have gone from just 17% of cash flow from operations to over 47%. This is a big red flag.

Accrued expenses are largely cash from the sale of gift cards. If gift cards go unused, and some do, they accrue 100% to operating income. AMZN doesn’t disclose the other sources of accrued expenses, but it isolates „unearned revenues“ in its cash flow statement (4) – this is gift card cash. As you can see, gift card sales have been a growing source of cash funding over the last three years, representing 43% of cash generated by operations in 2012. If I didn’t know exactly what business AMZN was in, I would be under the impression that it was trying to become a gift card sales operation.

My point here is that – at 43% of cash generated by operations – AMZN is become increasingly reliant on the „float“ it gets from gift cards in order to fund its operations on a short term basis. If AMZN’s revenues slow down or its expenses unexpectedly increase, for whatever reason, AMZN could face liquidity problems.

What happens if sales slow down because of a bad economy or predatory competitors? On Monday (March 3) Wal-Mart announced that it was going to start going after AMZN’s „Marketplace“ web vendor business: Wal-Mart/Amazon. This will likely „cannibalize“ AMZN’s „net service sales,“ which has gone from 10% of revenues to nearly 15% over the last three years. AMZN doesn’t break out its income from its revenue segments, but its Marketplace business is likely very high margin, meaning it’s become an important part of cash generated by operations. In addition, the imposition of the internet „Amazon tax“ will increase the customer’s all-in cost to buy from AMZN, which could significantly impact sales negatively.

AMZN’s market cap as of the 3/7/2013 close is $124.5 billion. Based on 2012 operating income, it’s trading at 185x operating income. For comparison purposes, WMT and TGT trade respectively at 9.2x and 8x their 2012 operating income. The p/e comparison is irrelevant because AMZN lost money on a net income basis in 2012, but that multiple of cash flow unequivocally represents an irrational „bubble“ valuation.

AMZN’s market cap has always been one of the unsolved mysteries of the stock market. Moreover, in its entire operating history, AMZN has never generated meaningful income or cash flow. It is clearly highly overvalued relative to its peers. But, I have rarely made money either shorting the stock or buying puts. It’s been a long-time source of frustration and at this point I’m going to wait until I see the signs that the Ponzi-like cash funding scheme AMZN has in place starts to deteriorate and then I’m going to pounce hard on the short side. Given that retail sales seem to be slowing down – and by some metrics declining – with the economy, and given that Wal-Mart is going to start throwing its weight around at one of AMZN’s key sources of cash flow, I don’t think I’ll have to wait much longer.

Apple Watch Event: Uhrsache (sic!) und Wirkung

Der Spiegel Online analysiert knallhart:

„Erst eingehende Tests werden zeigen, ob die Benutzung der neuen Uhren tatsächlich so intuitiv und angenehm ist, wie Cook und sein Team das bei der Vorstellung ein ums andere Mal betont haben. Sicher ist, dass Apple bis heute einen Vertrauensvorsprung hat, wenn es um die Einführung neuer Geräte geht. Steve Jobs versprach einst: Wenn wir etwas anfassen, dann machen wir es so, dass die Kunden es lieben werden. Löst die Apple Watch dieses Versprechen ein, dann kann sie einmal mehr einer Gerätekategorie zum Durchbruch verhelfen, bei denen andere die undankbare Vorreiterrolle übernommen haben. So wie das bei MP3-Playern, Touchscreen-Handys oder tragbaren Touch-Computern schon der Fall war.“

Und subsummiert, die Ängste, aller Beteiligten, Mitarbeiter, Fan-Boys, überzeugten Innovationsliebhabern, und Aktionären:

„Erweist sich die Apple Watch aber als überflüssiger Schnickschnack, als allzu klobiges Anhängsel mit zu wenig echtem Mehrwert für seinen Preis, dann kann die Uhr das Gegenteil bewirken: Wenn der Konzern nur einmal unter Beweis stellt, dass nicht jedes seiner Produkte automatisch zum unverzichtbaren Alltagsgegenstand wird, könnte das der Beginn eines rapiden Abstiegs werden.“

Spiegel Online resümmiert:

„Die Ankündigung mit der vermutlich nachhaltigsten Wirkung aber ist die zugleich am wenigsten spektakuläre. Der berührungslose Bezahldienst Apple Pay ist einmal mehr eine aufpolierte Kopie bereits im Markt befindlicher Angebote, man denke nur an Google Wallet. Android-Handys mit NFC-Chips gibt es längst, das Zahlen per Handy aber hat sich bislang nirgends durchgesetzt. Apple aber hat im Smartphone-Bereich in den USA bis heute einen Marktanteil von 40 Prozent – und Cooks Mannschaft hat es offenbar verstanden, sich mit vielen großen Laden- und Restaurantketten zu verbünden.

Schafft Apple es, mit seinen neuen Geräten schnell große Kundenzahlen zu erreichen – und die Geschichte legt nahe, dass das klappen könnte, – könnte mit einem Mal auch das Zahlen mit dem Handy – oder der Uhr – zur Alltagsgeste werden.

Für Ladenketten könnte die Anschaffung der entsprechenden Hardware mit einer ausreichend großen, zahlungskräftigen Klientel plötzlich doch interessant werden, und genau das sind Apples Kunden. Und stehen die Scanner erst einmal an den Ladenkassen, sind auch die NFC-Chips in allen anderen Handyfabrikaten plötzlich wieder im Spiel. Wenn das geschieht, wenn unsere digitalen Alltagsbegleiter auch zu unserem bevorzugten Zahlungsmittel werden, ist das zwar bequem – es bringt aber auch völlig neue Datenschutz– und Sicherheitsprobleme mit sich.“

Derstandard ergänzt:

„Das US-Magazin „Fortune“ würdigte Cook seinerzeit als „das Genie hinter Steve“. Als Zuständiger für das operative Geschäft sorgte er dafür, dass nach Umsetzung der kühnen Visionen schwarze Zahlen in den Büchern standen. Jetzt muss Cook mit der Computeruhr beweisen, dass sein Apple die gleiche visionäre Kraft wie zu Zeiten von Jobs hat. Dieses Image hilft dem Konzern, weltweit Millionen seiner teuren Premium-Smartphones und Tablets zu verkaufen.“

Original-Zitate nachzulesen bei: http://www.spiegel.de/netzwelt/gadgets/apple-watch-iphone-6-und-smartwatch-koennten-bezahlverhalten-aendern-a-990734.html und http://derstandard.at/2000005390426/Tim-Cook-tritt-mit-Apple-Watch-aus-dem-Schatten-von