Source: https://www.nytimes.com/2022/11/11/technology/elon-musk-twitter-takeover.html

Mr. Musk ordered immediate layoffs, fired executives by email and laid down product deadlines, transforming the company.

SAN FRANCISCO — Elon Musk had a demand.

On Oct. 28, hours after completing his $44 billion buyout of Twitter the night before, Mr. Musk gathered several human-resource executives in a “war room” in the company’s offices in San Francisco. Prepare for widespread layoffs, he told them, six people with knowledge of the discussion said. Twitter’s work force needed to be slashed immediately, he said, and those who were cut would not receive bonuses that were set to be paid on Nov. 1.

The executives warned their new boss that his plan could violate employment laws and breach contracts with workers, leading to employee lawsuits, the people said. But Mr. Musk’s team said he was used to going to court and paying penalties, and was not worried about the risks. So Twitter’s human-resource, accounting and legal departments scrambled to figure out how to comply with his command.

Two days later, Mr. Musk learned exactly how costly those potential fines and lawsuits could be, three people said. Delays were also piling up as managers haggled over which employees to let go. He decided to wait on cutting jobs until after Nov. 1.

The order for immediate layoffs, the ensuing panic and the about-face reflect the chaos that has engulfed Twitter since Mr. Musk took over the company two weeks ago. The 51-year-old barreled in with ideas about how the social media service should operate, but with no comprehensive plan to execute them. Then he quickly ran into the business, legal and financial complexities of running a platform that has been called a global town square.

The fallout has often been excruciating, according to 36 current and former Twitter employees and people close to the company, as well as internal documents and workplace chat logs. Some top executives were summarily fired by email. One engineering manager, upon being told to cut hundreds of workers, vomited into a trash can. Others slept in the office as they worked grueling schedules to meet Mr. Musk’s orders.

Twitter, which is under financial pressure from debt and a slumping economy, is now unrecognizable compared with what it was a month ago. Last week, Mr. Musk slashed 50 percent of the company’s 7,500 employees. Executive resignations have continued. Misinformation proliferated on the platform during Tuesday’s midterm elections. A key project to expand revenue from subscriptions hit snags. Some advertisers have been aghast.

Mr. Musk, who did not respond to a request for comment, told employees in a meeting on Thursday that Twitter’s situation was grim.

“There’s a massive negative cash flow, and bankruptcy is not out of the question,” he said, according to a recording heard by The New York Times.

Mr. Musk added that they would need to work strenuously to keep the company afloat. “Those who are able to go hard core and play to win, Twitter is a good place,” he said. “And those who are not, totally understand, but then Twitter is not for you.”

‘Let that sink in!’

Mr. Musk arrived at Twitter’s San Francisco offices on Oct. 26, toting a white porcelain sink through the glass doors of the building. “Let that sink in!” he tweeted at the time, along with a video of his grand entrance.

Leslie Berland, Twitter’s chief marketing officer, encouraged employees to say hi to Mr. Musk and escorted him through the office. He was seen chatting with employees at the company coffee bar.

But the vibe quickly changed. The next day, Parag Agrawal, Twitter’s chief executive, and Ned Segal, the chief financial officer, were in the office, two people familiar with the situation said. Once they knew Mr. Musk’s acquisition of Twitter was closing that afternoon, they left the building, uncertain what the new owner would do.

Mr. Agrawal and Mr. Segal soon received emails saying they had been fired, two people familiar with the situation said. Vijaya Gadde, Twitter’s top legal and policy executive, and Sean Edgett, the general counsel, were also fired. Mr. Edgett, who was in Twitter’s offices at the time, was escorted out.

That evening, Twitter hosted a Halloween party called “Trick or Tweet” for employees and their families. Some workers dressed in costume and tried to keep the mood festive. Others cried and hugged one another.

Mr. Musk had brought his own advisers, many of whom had worked at his other businesses, such as the digital payments company PayPal and the electric carmaker Tesla. They parked themselves in the “war room,” on the second floor of a building attached to Twitter’s headquarters. The area, which Twitter used to fete big-spending advertisers and dignitaries, was stocked with company memorabilia.

The advisers included the venture capitalists David Sacks, Jason Calacanis and Sriram Krishnan; Mr. Musk’s personal lawyer Alex Spiro; his financial manager Jared Birchall; and Antonio Gracias, a former Tesla director. Joining in were engineers and others from Tesla; from Mr. Musk’s brain interface start-up, Neuralink; and from his tunneling company, the Boring Company.

At times, Mr. Musk was spotted with his 2-year-old son, X Æ A-12, at Twitter’s office as he greeted employees.

In meetings with Twitter executives, Mr. Musk was direct. At the Oct. 28 meeting with human-resource executives, he said he wanted to reduce the work force immediately, before a Nov. 1 date when employees would receive regularly scheduled retention bonuses in the form of vested stock. Tech companies often compensate employees with regular share grants, earned over time the longer they stay at the firm.

One Twitter team began creating a financial model to show the cost of the layoffs. Another built a model to demonstrate how much more Mr. Musk might pay in legal fees and fines if he proceeded with the rapid cuts, three people said.

On Oct. 30, Mr. Musk received word that the rapid approach could cost millions of dollars more than laying people off with their scheduled bonuses. He agreed to delay, four people said.

But he had a condition. Before paying the bonuses, Mr. Musk insisted on a payroll audit to confirm that Twitter’s employees were “real humans.” He voiced concerns that “ghost employees” who should not receive the money lingered in Twitter’s systems.

Mr. Musk tapped Robert Kaiden, Twitter’s chief accounting officer, to conduct the audit. Mr. Kaiden asked managers to verify that they knew certain employees and could confirm that they were human, according to three people and an internal document seen by The Times.

The Nov. 1 bonus date came and went with no mass layoffs. Mr. Kaiden was fired the next day and marched out of the building, five people with knowledge of the situation said.

A trip to New York

As Twitter managers compiled lists for layoffs, Mr. Musk flew to New York to meet with advertisers, who provide the bulk of Twitter’s revenue.

In some advertiser meetings, Mr. Musk proposed a system for Twitter users to choose the kind of content that the service exposed them to — akin to G to NC-17 movie ratings — implying that brands could then target their advertising on the platform better. He also committed to product improvements and more personalization for users and ads, two people with knowledge of the discussions said.

But his outreach was undercut by the departures of two New York-based Twitter executives — Ms. Berland and JP Maheu, a vice president in charge of advertising. They were well known in the advertising community.

Those Twitter executives “had great relationships with the senior-most people at the Fortune 500 — they were incredibly transparent and inclusive,” said Lou Paskalis, a longtime advertising executive. “Those things engender tremendous trust, and those things are now in question.”

Brands including Volkswagen Group, General Motors and United Airlines have said they will pause advertising on Twitter as they evaluate Mr. Musk’s ownership of the platform.

Mr. Musk elevated some managers at Twitter. He tapped Esther Crawford, a product manager, to revamp a subscription service called Twitter Blue. Mr. Musk wanted a new version of the service, which would cost $8 a month and include premium features and the verification check mark that was previously assigned for free to the accounts of celebrities, journalists and politicians to convey their authenticity.

He laid down a deadline: The team must finish Twitter Blue’s changes by Nov. 7 or its members would be fired.

Last week, Ms. Crawford shared a photo of herself sleeping at Twitter’s San Francisco offices in a sleeping bag and an eye mask, with the hashtag #SleepWhereYouWork.

Her message rubbed some colleagues the wrong way. They wondered in private chats why they should commit long working hours to a man who could fire them, according to five people and messages seen by The Times. On Twitter, Ms. Crawford responded to what she called “hecklers” by saying she had received supportive messages from other entrepreneurs and “builders of all types.”

The ax falls

The scope of layoffs was a moving target. Twitter managers were initially told to cut 25 percent of the work force, three people said. But Tesla engineers who reviewed Twitter’s code proposed deeper cuts to the engineering teams. Executives overseeing other parts of Twitter were told to expand their layoff lists.

Twitter executives also suggested assessing the lists for diversity and inclusion issues so the cuts would not hit people of color disproportionately and to avoid legal trouble. Mr. Musk’s team brushed aside the suggestion, two people said.

On Nov. 2, employees stumbled upon an open channel in the internal Slack messaging system where human resources and legal teams were discussing the layoffs. In a message seen by The Times, one employee said 3,738 workers could be laid off, or about half the work force. The message was widely shared internally.

That evening, Mr. Musk met with some advisers to settle on the reduction, according to a calendar invitation seen by The Times. They were joined by employees from Twitter’s human resources and staff from his other companies.

Anticipating the cuts, employees began bidding farewell to their colleagues, trading phone numbers and connecting on LinkedIn. They also pulled together documents and internal resources to help workers who survived the layoffs.

One engineering manager was approached by Mr. Musk’s advisers — or “goons,” as Twitter employees called them — with a list of hundreds of people he had to let go. He vomited into a trash can near his feet.

Late on Nov. 3, an email landed in employees’ inboxes. “In an effort to place Twitter on a healthy path, we will go through the difficult process of reducing our global work force,” the email, signed “Twitter,” said.

Pandemonium followed. While the note said employees would receive a follow-up email the next morning about whether they still had jobs, many found themselves locked out of email or Slack that night, an indication they had been laid off. Those who remained in Slack posted saluting emojis en masse as a send-off for co-workers.

The cuts were enormous. In Redbird, Twitter’s platform and infrastructure organization, Mr. Musk shed numerous managers. The unit also lost about 80 percent of its engineering staff, raising internal concerns about the company’s ability to keep its site up and running.

In Bluebird, Twitter’s consumer division, dozens of product managers were laid off, leaving just over a dozen of them. The new ratio of engineers to managers was 70 to 1, according to one estimate.

The aftermath

As layoffs unfolded, tech recruiters sensed opportunity. Top managers at rival companies such as Meta and Google sent messages to some of the employees being let go from Twitter, said two people who received the notes.

Most of Mr. Musk’s subordinates remained quiet throughout the process. But Mr. Calacanis, the venture capitalist, had been active on Twitter responding to product suggestions and concerns.

Last week, Mr. Musk dispatched a lieutenant to the “war room” to ask Mr. Calacanis, who was there, to cool it on Twitter and stop acting as if he were leading product development or policy, people familiar with the exchange said.

“To be clear, Elon is the product manager and CEO,” Mr. Calacanis later tweeted. “As a power user (and that’s all I am!) I’m really excited.”

By last Saturday, Mr. Musk’s advisers realized that the cuts may have been too deep, four people said. Some asked laid-off engineers, designers and product managers to return to their old jobs, three people familiar with the conversations said. The tech newsletter Platformer earlier reported the outreach.

At Goldbird, Twitter’s revenue division, the company had to bring back those who ran key money-generating products that “no one else knows how to operate,” people with knowledge of the business said. One manager agreed to try rehiring some laid-off workers, but expressed concerns that they were “weak, lazy, unmotivated and they may even be against an Elon Twitter,” two people familiar with the matter said.

On Monday, some Twitter employees arrived at work to find that certain systems they had relied on no longer worked. In San Francisco, an engineer discovered that some contracts with vendors that provide software for managing user data had been put on hold or had expired, and that the managers and executives who could fix the problem had been laid off or resigned.

On Wednesday, workers in Twitter’s New York office were unable to use the Wi-Fi after a server room overheated and knocked it offline, two people said.

Mr. Musk plans to begin making employees pay for lunch — which had been free — at the company cafeteria, two people said.

An internal clash

Inside Twitter, some employees have clashed with Mr. Musk’s advisers.

This week, security executives disagreed with Mr. Musk’s team over how Twitter should meet its obligations to the Federal Trade Commission. Twitter had agreed to a settlement with the F.T.C. in 2011 over privacy violations, which requires the company to submit regular reports about its privacy practices and open its doors to audits.

On Wednesday, a day before a deadline for Twitter to submit a report to the F.T.C., Twitter’s chief information security officer, Lea Kissner; chief privacy officer, Damien Kieran; and chief compliance officer, Marianne Fogarty, resigned.

In internal messages later that day, an employee wrote about the resignations and suggested that internal privacy reviews of Twitter’s products were not proceeding as they should under the F.T.C. settlement.

Some engineers could be required to “self-certify” that their projects complied with the settlement, rather than relying on reviews from lawyers and executives, a shift that could lead to “major incidents,” the employee wrote.

“Elon has shown that his only priority with Twitter users is how to monetize them,” the person wrote in the message, which was viewed by The Times.

The employee added that Mr. Spiro, Mr. Musk’s lawyer, had said the billionaire was willing to take risks. Mr. Spiro, the employee said, told workers that “Elon puts rockets into space — he’s not afraid of the F.T.C.”

The F.T.C. said that it was tracking the developments at Twitter with “deep concern” and that “no C.E.O. or company is above the law.” Mr. Musk later sent employees an email saying Twitter will adhere to the F.T.C. settlement.

On Thursday, more Twitter executives resigned, including Kathleen Pacini, a human-resource leader, and Yoel Roth, the head of trust and safety.

At the meeting with employees that day, Mr. Musk tried to sound a note of optimism about Twitter’s future.

“Twitter can form an incredibly valuable service to the world and be the public town square,” he said, noting it should be a “battleground of ideas” where debate could “take the place of violence in a lot of cases.”

Photograph: Luka Milanovic/Getty Images

Photograph: Luka Milanovic/Getty Images

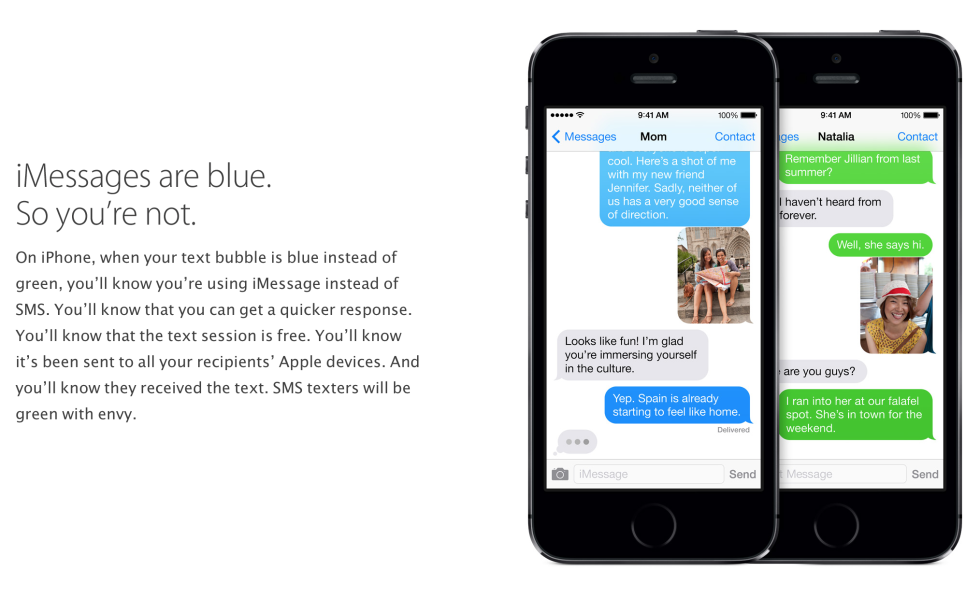

When Adele Lowitz, left, experimented with using an Android smartphone instead of an iPhone, one friend asked: ‘Who’s green?’ PHOTO: STEVE KOSS FOR THE WALL STREET JOURNAL

When Adele Lowitz, left, experimented with using an Android smartphone instead of an iPhone, one friend asked: ‘Who’s green?’ PHOTO: STEVE KOSS FOR THE WALL STREET JOURNAL How Apple’s iPhone and Apps Trap You in a Walled GardenApple’s hardware, software and services work so harmoniously that it is often called a “walled garden.” The idea is central to recent antitrust scrutiny and the Epic vs. Apple case. WSJ’s Joanna Stern went to a real walled garden to explain it all. Photo illustration: Adele Morgan/The Wall Street Journal

How Apple’s iPhone and Apps Trap You in a Walled GardenApple’s hardware, software and services work so harmoniously that it is often called a “walled garden.” The idea is central to recent antitrust scrutiny and the Epic vs. Apple case. WSJ’s Joanna Stern went to a real walled garden to explain it all. Photo illustration: Adele Morgan/The Wall Street Journal

/cdn.vox-cdn.com/uploads/chorus_image/image/69409301/acastro_180604_1777_apple_wwdc_0004.0.jpg)

Source: Amazon

Source: Amazon Source: Nate D Sanders Auctions

Source: Nate D Sanders Auctions